As of late 2025, global average GDP growth is estimated around 3.2%–3.3%, reflecting a slowdown and structural headwinds across major economies. In contrast, India’s GDP grew at an average rate of nearly 8% during the first half of FY2026, significantly outperforming the global average and positioning India among the fastest‑growing large economies.

Despite this strong economic expansion and positive domestic fundamentals, the Indian Rupee (INR) has been weakening sharply against the US Dollar (USD).

What’s Driving the Indian Rupee’s Weakness?

Recent Performance and Downward Trend

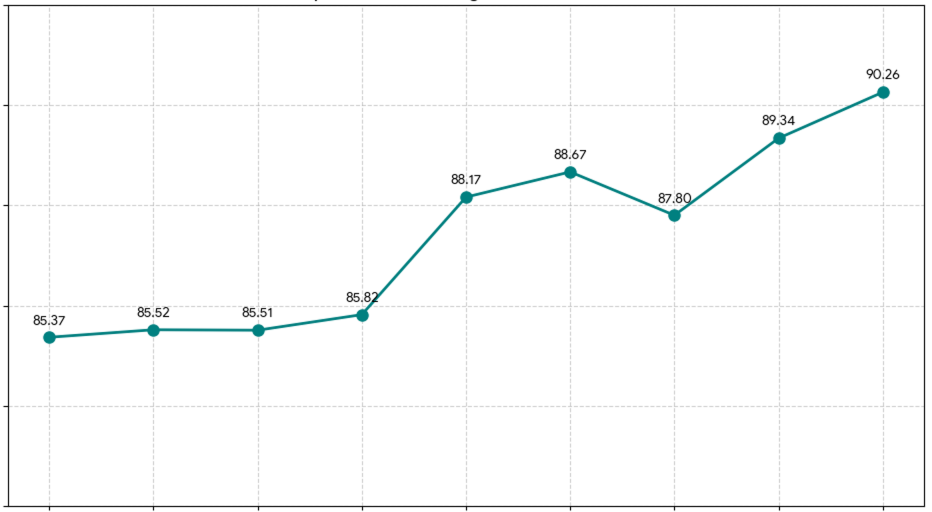

- The Indian rupee hit a record low of ₹91.02 per US dollar in December 2025, marking a decline of nearly 6% during the year

- It has emerged as one of the worst‑performing Asian currencies in 2025, despite India’s robust GDP growth.

- Foreign investors have withdrawn nearly $18 billion from Indian equities in 2025, intensifying downward pressure.

Why Is the Rupee Falling Despite Economic Growth?

A growing economy doesn’t automatically mean a stronger currency. The rupee’s weakness is largely driven by external and global factors, including:

- A Strong US dollar, supported by higher US interest rates.

- Capital outflows, as foreign institutional investors shift funds toward safer or higher‑yielding assets.

- Persistent trade deficit pressures, driven by higher imports relative to exports.

As a result, while India’s GDP continues to expand, the rupee reflects global capital flows and investor sentiment, not domestic growth alone.

How International and Gold Price Impact

- Rising global gold prices increase India’s import bill, as India is one of the largest gold importers.

- Higher crude oil prices further worsen the current account deficit, adding downward pressure on the rupee.

- International uncertainties, including US tariffs on Indian goods, have further strained the currency.

What’s India’s Plan and What Should Be the Next Action

The Reserve Bank of India does not try to fix the rupee at a specific level.

Instead, RBI intervenes only to control sharp and sudden falls, not to stop natural market movement.

- The Reserve Bank of India (RBI) has intervened by selling US dollars to stabilize the rupee, but this provides only temporary relief.

- Key policy measures under consideration include:

- Boosting exports to balance trade deficits.

- Encouraging Foreign Direct Investment (FDI) inflows to strengthen capital accounts.

- Diversifying foreign exchange reserves and managing external debt exposure.

India must also strengthen domestic manufacturing and reduce import dependency, especially on energy and gold, to protect the rupee in the long run.

What Could Be the Rupees Trend in 2026?

Looking ahead to 2026, three broad possibilities exist:

- Analysts expect the rupee to remain volatile but may stabilize around ₹88–90 per US dollar in 2026, provided global conditions ease.

- A rebound could be supported by:

- Improved trade deals with the US and other partners.

- Lower global inflation and interest rates, reducing dollar strength.

- Continued GDP growth above 7%,which could attract foreign capital back.

- However, risks remain if oil prices surge or if global geopolitical tensions escalate, which could keep the rupee under pressure.

Overall, a major recovery may take time, but a stable and controlled rupee movement is more likely than a sudden crash.

Conclusion

India’s economy is growing faster than most countries in the world, and its long-term outlook remains strong. However, currency markets are influenced by multiple forces beyond GDP data—from investor flows and external demand to commodity prices and global monetary policy.

The weakening of the rupee is not a sign of economic failure, but a result of global factors, strong US dollar demand, and controlled policy decisions by the RBI. With calibrated policy actions and improving external conditions, the rupee’s trend in 2026 could shift toward greater stability, even if gradual adjustments continue.

Grostreet.com is an educational knowledge hub covering finance, economics, and global geopolitics. Our articles are designed to break down complex topics into clear, practical insights, empowering students, investors, and curious readers with strong financial literacy.